Blockchain in Trade Finance: Revolutionizing Global Commerce

Aug 12, 2024

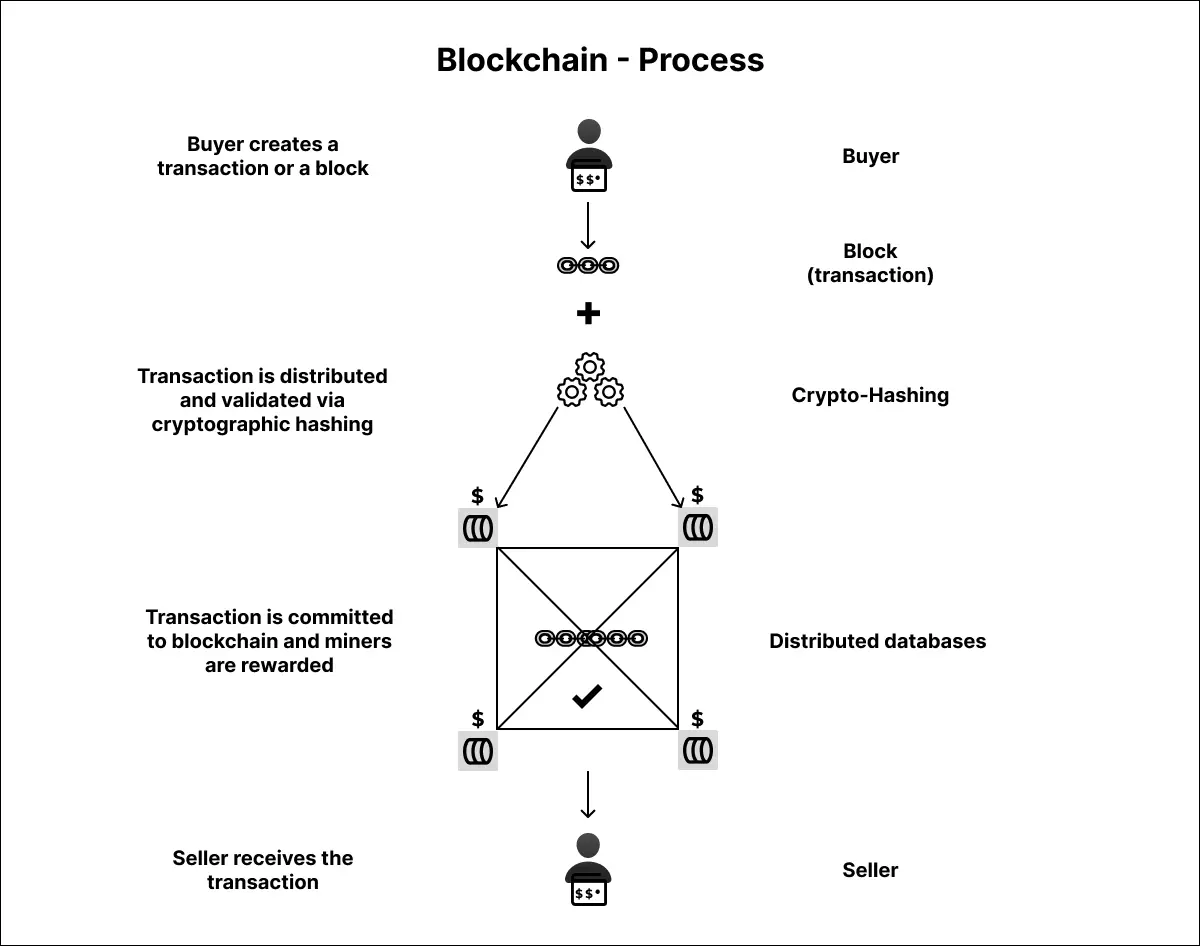

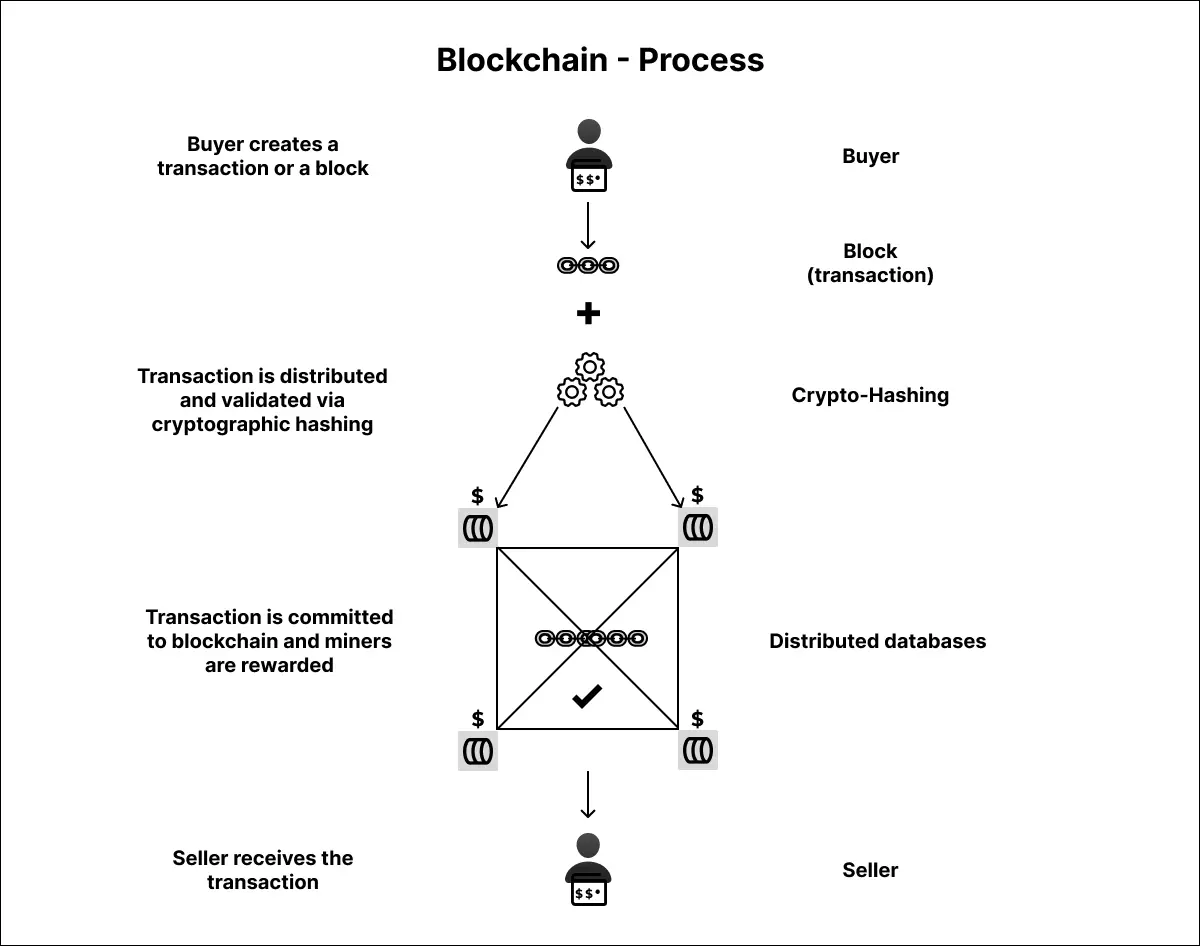

Blockchain technology is emerging faster as a recreation-changer in diverse industries, and alternate finance is no exception. Conventional change finance techniques, regularly plagued with inefficiencies, delays, and a lack of transparency, are ripe for transformation. With a global trade finance market worth about $10 trillion, the ability impact of blockchain is tremendous. By leveraging its decentralised and immutable ledger, blockchain promises to revolutionize alternate finance by improving efficiency, transparency, and safety throughout all transactions.

The lack of decentralization in traditional alternate finance structures creates substantial geoeconomic issues, such as inefficiencies, better charges, and improved susceptibility to fraud and corruption. Moreover, political elements can closely stimulate centralised systems, leading to unequal admission to change finance services. Blockchain technology addresses these challenges by decentralizing the change finance method, creating a more equitable and resilient global exchange. This transformation streamlines operations and fosters more agree-with and collaboration amongst buying and selling companions worldwide.

What Makes a Lack of Decentralization in Trade Finance a Geoeconomics Issue?

When alternate finance structures are managed using some vast banks, issues affect the whole global alternate system. This centralization results in better expenses, longer processing instances, and a greater danger of fraud and corruption. For example, if we use blockchain technology, which is decentralized, we may want to reduce trade finance costs by using up to 30%. This may also help the growth of international change through up to $1 trillion through 2025.

Additionally, while change finance systems are controlled with the aid of some big banks, they may be inspired via politics and monetary sanctions. This means some nations or regions can also have limited admission to trade finance offerings, which may worsen financial inequalities.

According to the International Chamber of Commerce, there may be a $1.5 trillion gap in alternate finance availability, disproportionately affecting small and medium-sized businesses and groups in developing international locations. Decentralized blockchain answers can help solve these problems by supplying a resilient platform less susceptible to external impacts and promoting an inclusive and fair global environment.

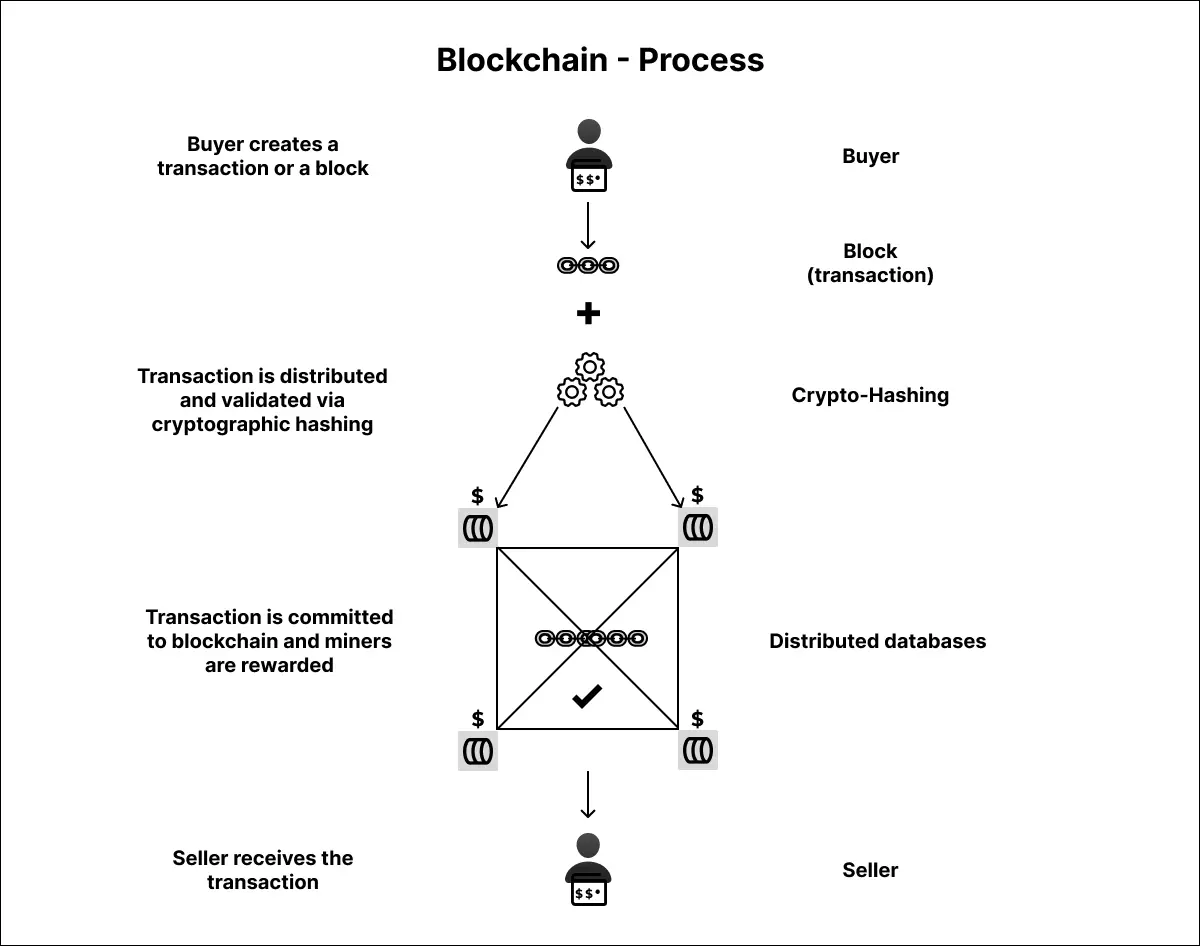

Performing Trade Finance Using Blockchain: The Core Outcomes

➢ Efficiency

Blockchain complements the efficiency of exchange finance by automating and streamlining methods. Smart contracts can execute transactions mechanically when predefined situations are met, decreasing the want for guide intervention and related delays. This ends in quicker transaction instances, lower operational expenses, and improved agency liquidity. According to a study using Capgemini, blockchain can reduce transaction expenses by up to 30%.

➢ Traceability and Auditability

Blockchain's immutable ledger offers a transparent, tamper-evidence report of all transactions. This traceability ensures that each step within the alternate finance manner may be audited and demonstrated, reducing the chance of fraud and mistakes. The potential to track goods and payments in real-time also complements trust among trading partners. A PwC file highlights that blockchain can lessen alternate documentation processing times by 80%.

➢ Transparency

The blockchain era promotes transparency in change finance by making all transaction information reachable to legal events. This openness reduces records asymmetry, giving all stakeholders a clear view of the exchange lifecycle. Enhanced transparency allows building acceptance as accurate and might lead to better compliance with regulatory necessities. The Global Trade Organization estimates blockchain should grow international exchange by $1 trillion through 2025 due to more suitable transparency and efficiency.

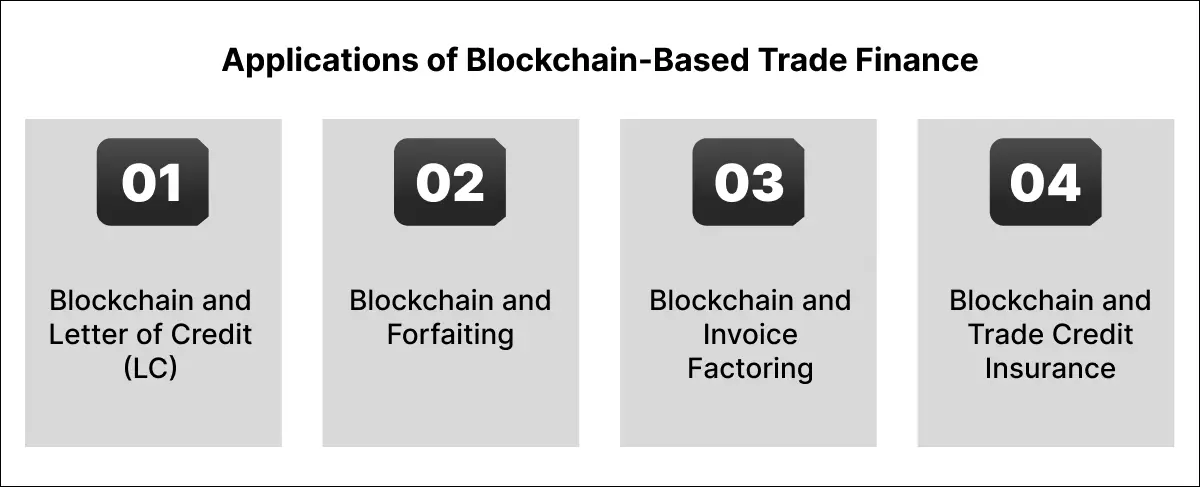

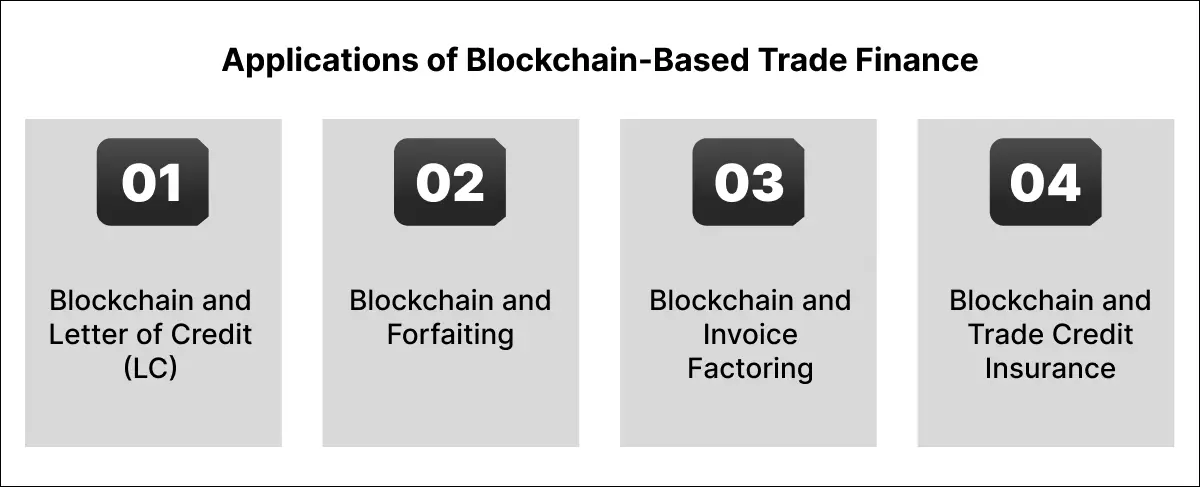

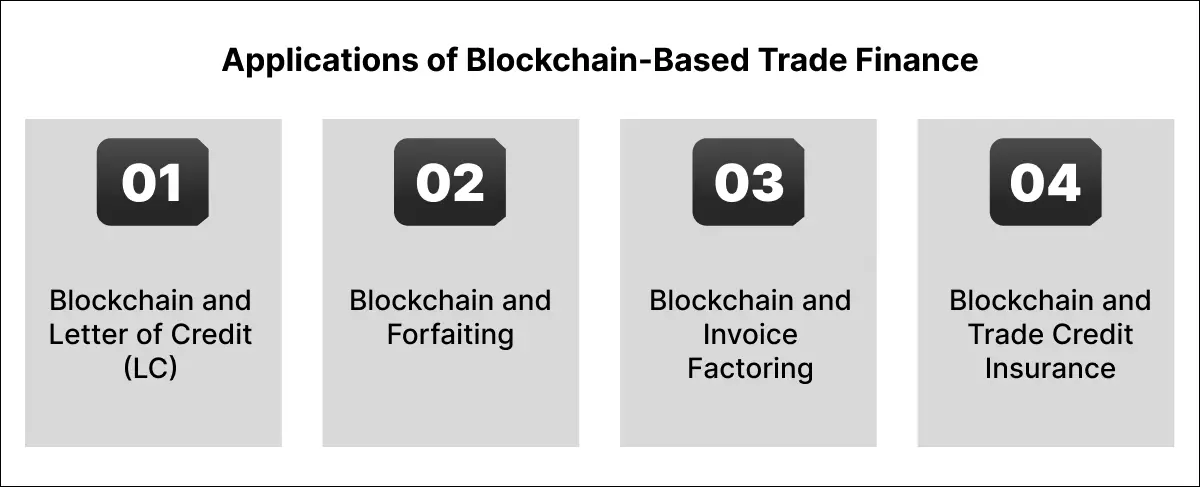

Applications of Blockchain-Based Trade Finance – A Look at Instruments

➢ Blockchain and Letter of Credit (LC)

Letters of Credit are crucial in international alternatives, providing price assurance to exporters and price deferral to importers. Blockchain can digitize and automate the LC procedure, lowering the time and fee associated with traditional LCs. Smart contracts can ensure that payment is made robotically once the phrases of the LC are fulfilled, enhancing consideration and performance. The International Chamber of Commerce (ICC) indicates that blockchain may want to reduce LC processing instances from 5-10 days to less than 24 hours.

➢ Blockchain and Forfaiting

Forfaiting includes the sale of receivables from Global change transactions. Blockchain can facilitate forfeiting by offering a stable, transparent platform for buying and selling receivables. This reduces the risk for buyers and sellers, making it less challenging to get admission to financing and improving coin flow control. A study by Deloitte shows that blockchain may want to reduce the fees associated with forfeiting by up to 50%.

➢ Blockchain and Invoice Factoring

Invoice factoring allows groups to promote their invoices to a third party at a discount in trade for immediate cash. Blockchain can streamline the factoring manner by providing real-time verification of invoices, lowering the danger of fraud, and speeding up the approval technique. This results in faster entry to the price range and higher economic management for corporations. According to the Global Economic Forum, blockchain could lessen factor prices by 20-30%.

➢ Blockchain and Trade Credit Insurance

Trade credit score insurance protects agencies in opposition to the threat of non-payment using buyers. Blockchain can enhance the effectiveness of trade credit insurance by offering a transparent file of transactions and claims. This improves the accuracy of danger assessments and helps quicker claims processing, imparting better safety for groups concerned with international trade. A document by Marsh & McLennan notes that blockchain should lessen the time taken for claims processing by 40%.

Conclusion

The blockchain era is poised to transform change finance by addressing lengthy, demanding situations. By enhancing efficiency, traceability, auditability, and transparency, blockchain could make global trade more secure, equitable, and efficient. Adopting blockchain-based change finance instruments, including Letters of Credit, forfeiting, bill factoring, and exchange credit insurance, will pave the way for a more resilient and inclusive worldwide change ecosystem. As the era continues to evolve, stakeholders need to collaborate and embrace those improvements to recognize the ability of blockchain to change finance entirely. The capability of a $1 trillion boost in worldwide change using 2025 underscores blockchain's transformative impact on the arena.

Ready to transform your trade finance with blockchain? DecentraBlock offers expert blockchain development services that can streamline your operations, improve transparency, and boost efficiency. Get in touch with us today to start your journey toward a smarter, more secure trade finance system.

Blockchain technology is emerging faster as a recreation-changer in diverse industries, and alternate finance is no exception. Conventional change finance techniques, regularly plagued with inefficiencies, delays, and a lack of transparency, are ripe for transformation. With a global trade finance market worth about $10 trillion, the ability impact of blockchain is tremendous. By leveraging its decentralised and immutable ledger, blockchain promises to revolutionize alternate finance by improving efficiency, transparency, and safety throughout all transactions.

The lack of decentralization in traditional alternate finance structures creates substantial geoeconomic issues, such as inefficiencies, better charges, and improved susceptibility to fraud and corruption. Moreover, political elements can closely stimulate centralised systems, leading to unequal admission to change finance services. Blockchain technology addresses these challenges by decentralizing the change finance method, creating a more equitable and resilient global exchange. This transformation streamlines operations and fosters more agree-with and collaboration amongst buying and selling companions worldwide.

What Makes a Lack of Decentralization in Trade Finance a Geoeconomics Issue?

When alternate finance structures are managed using some vast banks, issues affect the whole global alternate system. This centralization results in better expenses, longer processing instances, and a greater danger of fraud and corruption. For example, if we use blockchain technology, which is decentralized, we may want to reduce trade finance costs by using up to 30%. This may also help the growth of international change through up to $1 trillion through 2025.

Additionally, while change finance systems are controlled with the aid of some big banks, they may be inspired via politics and monetary sanctions. This means some nations or regions can also have limited admission to trade finance offerings, which may worsen financial inequalities.

According to the International Chamber of Commerce, there may be a $1.5 trillion gap in alternate finance availability, disproportionately affecting small and medium-sized businesses and groups in developing international locations. Decentralized blockchain answers can help solve these problems by supplying a resilient platform less susceptible to external impacts and promoting an inclusive and fair global environment.

Performing Trade Finance Using Blockchain: The Core Outcomes

➢ Efficiency

Blockchain complements the efficiency of exchange finance by automating and streamlining methods. Smart contracts can execute transactions mechanically when predefined situations are met, decreasing the want for guide intervention and related delays. This ends in quicker transaction instances, lower operational expenses, and improved agency liquidity. According to a study using Capgemini, blockchain can reduce transaction expenses by up to 30%.

➢ Traceability and Auditability

Blockchain's immutable ledger offers a transparent, tamper-evidence report of all transactions. This traceability ensures that each step within the alternate finance manner may be audited and demonstrated, reducing the chance of fraud and mistakes. The potential to track goods and payments in real-time also complements trust among trading partners. A PwC file highlights that blockchain can lessen alternate documentation processing times by 80%.

➢ Transparency

The blockchain era promotes transparency in change finance by making all transaction information reachable to legal events. This openness reduces records asymmetry, giving all stakeholders a clear view of the exchange lifecycle. Enhanced transparency allows building acceptance as accurate and might lead to better compliance with regulatory necessities. The Global Trade Organization estimates blockchain should grow international exchange by $1 trillion through 2025 due to more suitable transparency and efficiency.

Applications of Blockchain-Based Trade Finance – A Look at Instruments

➢ Blockchain and Letter of Credit (LC)

Letters of Credit are crucial in international alternatives, providing price assurance to exporters and price deferral to importers. Blockchain can digitize and automate the LC procedure, lowering the time and fee associated with traditional LCs. Smart contracts can ensure that payment is made robotically once the phrases of the LC are fulfilled, enhancing consideration and performance. The International Chamber of Commerce (ICC) indicates that blockchain may want to reduce LC processing instances from 5-10 days to less than 24 hours.

➢ Blockchain and Forfaiting

Forfaiting includes the sale of receivables from Global change transactions. Blockchain can facilitate forfeiting by offering a stable, transparent platform for buying and selling receivables. This reduces the risk for buyers and sellers, making it less challenging to get admission to financing and improving coin flow control. A study by Deloitte shows that blockchain may want to reduce the fees associated with forfeiting by up to 50%.

➢ Blockchain and Invoice Factoring

Invoice factoring allows groups to promote their invoices to a third party at a discount in trade for immediate cash. Blockchain can streamline the factoring manner by providing real-time verification of invoices, lowering the danger of fraud, and speeding up the approval technique. This results in faster entry to the price range and higher economic management for corporations. According to the Global Economic Forum, blockchain could lessen factor prices by 20-30%.

➢ Blockchain and Trade Credit Insurance

Trade credit score insurance protects agencies in opposition to the threat of non-payment using buyers. Blockchain can enhance the effectiveness of trade credit insurance by offering a transparent file of transactions and claims. This improves the accuracy of danger assessments and helps quicker claims processing, imparting better safety for groups concerned with international trade. A document by Marsh & McLennan notes that blockchain should lessen the time taken for claims processing by 40%.

Conclusion

The blockchain era is poised to transform change finance by addressing lengthy, demanding situations. By enhancing efficiency, traceability, auditability, and transparency, blockchain could make global trade more secure, equitable, and efficient. Adopting blockchain-based change finance instruments, including Letters of Credit, forfeiting, bill factoring, and exchange credit insurance, will pave the way for a more resilient and inclusive worldwide change ecosystem. As the era continues to evolve, stakeholders need to collaborate and embrace those improvements to recognize the ability of blockchain to change finance entirely. The capability of a $1 trillion boost in worldwide change using 2025 underscores blockchain's transformative impact on the arena.

Ready to transform your trade finance with blockchain? DecentraBlock offers expert blockchain development services that can streamline your operations, improve transparency, and boost efficiency. Get in touch with us today to start your journey toward a smarter, more secure trade finance system.

Blockchain technology is emerging faster as a recreation-changer in diverse industries, and alternate finance is no exception. Conventional change finance techniques, regularly plagued with inefficiencies, delays, and a lack of transparency, are ripe for transformation. With a global trade finance market worth about $10 trillion, the ability impact of blockchain is tremendous. By leveraging its decentralised and immutable ledger, blockchain promises to revolutionize alternate finance by improving efficiency, transparency, and safety throughout all transactions.

The lack of decentralization in traditional alternate finance structures creates substantial geoeconomic issues, such as inefficiencies, better charges, and improved susceptibility to fraud and corruption. Moreover, political elements can closely stimulate centralised systems, leading to unequal admission to change finance services. Blockchain technology addresses these challenges by decentralizing the change finance method, creating a more equitable and resilient global exchange. This transformation streamlines operations and fosters more agree-with and collaboration amongst buying and selling companions worldwide.

What Makes a Lack of Decentralization in Trade Finance a Geoeconomics Issue?

When alternate finance structures are managed using some vast banks, issues affect the whole global alternate system. This centralization results in better expenses, longer processing instances, and a greater danger of fraud and corruption. For example, if we use blockchain technology, which is decentralized, we may want to reduce trade finance costs by using up to 30%. This may also help the growth of international change through up to $1 trillion through 2025.

Additionally, while change finance systems are controlled with the aid of some big banks, they may be inspired via politics and monetary sanctions. This means some nations or regions can also have limited admission to trade finance offerings, which may worsen financial inequalities.

According to the International Chamber of Commerce, there may be a $1.5 trillion gap in alternate finance availability, disproportionately affecting small and medium-sized businesses and groups in developing international locations. Decentralized blockchain answers can help solve these problems by supplying a resilient platform less susceptible to external impacts and promoting an inclusive and fair global environment.

Performing Trade Finance Using Blockchain: The Core Outcomes

➢ Efficiency

Blockchain complements the efficiency of exchange finance by automating and streamlining methods. Smart contracts can execute transactions mechanically when predefined situations are met, decreasing the want for guide intervention and related delays. This ends in quicker transaction instances, lower operational expenses, and improved agency liquidity. According to a study using Capgemini, blockchain can reduce transaction expenses by up to 30%.

➢ Traceability and Auditability

Blockchain's immutable ledger offers a transparent, tamper-evidence report of all transactions. This traceability ensures that each step within the alternate finance manner may be audited and demonstrated, reducing the chance of fraud and mistakes. The potential to track goods and payments in real-time also complements trust among trading partners. A PwC file highlights that blockchain can lessen alternate documentation processing times by 80%.

➢ Transparency

The blockchain era promotes transparency in change finance by making all transaction information reachable to legal events. This openness reduces records asymmetry, giving all stakeholders a clear view of the exchange lifecycle. Enhanced transparency allows building acceptance as accurate and might lead to better compliance with regulatory necessities. The Global Trade Organization estimates blockchain should grow international exchange by $1 trillion through 2025 due to more suitable transparency and efficiency.

Applications of Blockchain-Based Trade Finance – A Look at Instruments

➢ Blockchain and Letter of Credit (LC)

Letters of Credit are crucial in international alternatives, providing price assurance to exporters and price deferral to importers. Blockchain can digitize and automate the LC procedure, lowering the time and fee associated with traditional LCs. Smart contracts can ensure that payment is made robotically once the phrases of the LC are fulfilled, enhancing consideration and performance. The International Chamber of Commerce (ICC) indicates that blockchain may want to reduce LC processing instances from 5-10 days to less than 24 hours.

➢ Blockchain and Forfaiting

Forfaiting includes the sale of receivables from Global change transactions. Blockchain can facilitate forfeiting by offering a stable, transparent platform for buying and selling receivables. This reduces the risk for buyers and sellers, making it less challenging to get admission to financing and improving coin flow control. A study by Deloitte shows that blockchain may want to reduce the fees associated with forfeiting by up to 50%.

➢ Blockchain and Invoice Factoring

Invoice factoring allows groups to promote their invoices to a third party at a discount in trade for immediate cash. Blockchain can streamline the factoring manner by providing real-time verification of invoices, lowering the danger of fraud, and speeding up the approval technique. This results in faster entry to the price range and higher economic management for corporations. According to the Global Economic Forum, blockchain could lessen factor prices by 20-30%.

➢ Blockchain and Trade Credit Insurance

Trade credit score insurance protects agencies in opposition to the threat of non-payment using buyers. Blockchain can enhance the effectiveness of trade credit insurance by offering a transparent file of transactions and claims. This improves the accuracy of danger assessments and helps quicker claims processing, imparting better safety for groups concerned with international trade. A document by Marsh & McLennan notes that blockchain should lessen the time taken for claims processing by 40%.

Conclusion

The blockchain era is poised to transform change finance by addressing lengthy, demanding situations. By enhancing efficiency, traceability, auditability, and transparency, blockchain could make global trade more secure, equitable, and efficient. Adopting blockchain-based change finance instruments, including Letters of Credit, forfeiting, bill factoring, and exchange credit insurance, will pave the way for a more resilient and inclusive worldwide change ecosystem. As the era continues to evolve, stakeholders need to collaborate and embrace those improvements to recognize the ability of blockchain to change finance entirely. The capability of a $1 trillion boost in worldwide change using 2025 underscores blockchain's transformative impact on the arena.

Ready to transform your trade finance with blockchain? DecentraBlock offers expert blockchain development services that can streamline your operations, improve transparency, and boost efficiency. Get in touch with us today to start your journey toward a smarter, more secure trade finance system.

DecentraBlock is at the forefront of blockchain innovation, revolutionizing how businesses secure, transact, and grow in the digital age. Join us on a journey to harness the full potential of decentralized technology for a more efficient and transparent future.

Services

Subscribe to Our Newsletter

Get the latest news, updates, and insights on blockchain technology directly to your inbox. Sign up for our newsletter today!

© 2024 DecentraBlock. All rights reserved.

DecentraBlock is at the forefront of blockchain innovation, revolutionizing how businesses secure, transact, and grow in the digital age. Join us on a journey to harness the full potential of decentralized technology for a more efficient and transparent future.

Services

Subscribe to Our Newsletter

Get the latest news, updates, and insights on blockchain technology directly to your inbox. Sign up for our newsletter today!

© 2024 DecentraBlock. All rights reserved.

DecentraBlock is at the forefront of blockchain innovation, revolutionizing how businesses secure, transact, and grow in the digital age. Join us on a journey to harness the full potential of decentralized technology for a more efficient and transparent future.

Services

Subscribe to Our Newsletter

Get the latest news, updates, and insights on blockchain technology directly to your inbox. Sign up for our newsletter today!

© 2024 DecentraBlock. All rights reserved.