A Comprehensive Guide to the DeFi Ecosystem

Nov 7, 2024

They offer customers stability in the otherwise volatile cryptocurrency market, providing a reliable alternative to traditional financial options. The emergence of the Decentralized Finance (DeFi) environment in recent years has brought about a major upheaval in the world of finance. DeFi has emerged as a progressive approach, providing conventional monetary institutions, beset by limitations and inefficiencies, with a decentralized, transparent, and inclusive opportunity. With blockchain technology and smart contracts, DeFi is growing to get admission to monetary tools, converting how monetary offerings are added, and empowering individuals to control their belongings like never before.

In this article, we will delve into the intricate workings of the DeFi ecosystem, highlighting its core principles, benefits, and diverse range of applications that have contributed to its rapid growth. In this blog, we will discuss DeFi's key principles, the issues they address, and how DeFi could potentially transform international financial practices. You can even find out how DeFi is revolutionizing the finance area and setting the stage for a more obvious and decentralized destiny.

What is a DeFi Ecosystem?

The DeFi Ecosystem, short for Decentralized Finance, is a network of economic programs built on blockchain technology. Unlike conventional monetary structures, which rely on intermediaries like banks and brokerages, DeFi operates on decentralized networks wherein transactions are ruled by smart contracts and peer-to-peer protocols.

Here’s a breakdown of the key additives and features of the DeFi Ecosystem:

Blockchain Technology: The foundation of DeFi is blockchain, which ensures the transparency, security, and immutability of transactions. Ethereum is the most popular blockchain for DeFi projects due to its strong, smart contract capabilities.

Smart Contracts: The situations of the contracts were explicitly encoded into code in those self-executing contracts. Smart contracts cast off the need for middlemen with the aid of automating and imposing a settlement’s requirements.

Decentralized Exchanges (DEXs): Platforms like Uniswap and Sushiswap permit customers to alternate cryptocurrencies directly with each other without a central authority. This reduces the risk of hacks and fraud related to centralized exchanges.

Decentralized Finance Applications: A diverse range of monetary offerings built on blockchain, consisting of lending protocols (like Compound and Aave), decentralized derivatives (like Synthetix), decentralized stablecoins (like MakerDAO), and yield farming protocols.

Liquidity Pools: Pools of tokens locked in smart contracts offer liquidity for decentralized change trading, permitting customers to exchange property seamlessly at the same time as earning fees or rewards.

Governance Tokens: Tokens supply holders with vote-casting rights and impact the decision-making method of decentralized protocols, empowering the community to control and evolve the surroundings.

Yield Farming: A method where customers provide liquidity to DeFi protocols in exchange for rewards, typically in the shape of extra tokens, governance rights, or a proportion of transaction expenses.

Flash Loans: Unsecured loans that are instantly borrowed and repaid within the identical transaction, enabled by way of smart contracts, often used for arbitrage and different buying and selling strategies without the need for collateral.

Automated Market Makers (AMMs): Decentralized protocols that use algorithms and liquidity swimming pools to facilitate token swaps, making sure non-stop liquidity and decreasing rate slippage for investors.

Interoperability: The potential of various DeFi protocols and systems to seamlessly engage and talk with each other, enhancing the general performance, usability, and composability of the atmosphere.

Understand the basics of the DeFi ecosystem

The fundamentals of the DeFi atmosphere are blockchain technology, smart contracts, and the ambition to update traditional monetary institutions. Building a decentralized, transparent, and open financial system without middlemen is the number one aim of DeFi.

The blockchain technology is the foundation of the DeFi environment. Transparency and immutability are ensured through a device called allotted ledgers, which makes use of a decentralized community of nodes to store records and transactions. Decentralization reduces the possibility of fraud and manipulation and does away with the necessity for centralized management.

Smart contracts, the fundamental components of DeFi programs, enable self-reliant and self-executing agreements. The execution of many monetary methods, which include borrowing, lending, buying and selling, and yield farming, is made simpler by using these programmable contracts. Smart contracts simplify transactions when specific conditions are met, thereby improving environmental protection and consideration.

Decentralized applications (dApps), which provide the consumer interface, enable customers to interact with DeFi protocols. These blockchain-based applications give users access to a variety of financial products and services. With the help of dApps, customers may manipulate their property, participate in decentralized exchanges, and apply for loans without the assistance of traditional monetary middlemen.

Interoperability is another crucial component of the DeFi environment. As the DeFi industry grows, initiatives are focusing on establishing go-chain interoperability to enhance accessibility and liquidity across various blockchain networks.

Despite its amazing promise, the DeFi atmosphere has challenges associated with scalability, protection, and regulatory compliance. However, its essential principles of accessibility, openness, and decentralization have sparked an economic revolution that has upended traditional banking and laid the foundation for a destiny in finance that is extra equitable and inclusive.

Objectives of a DeFi Ecosystem

One of the important principles of DeFi is peer-to-peer (P2P) financial transactions, in which two humans consent to trade cryptocurrency for services or products without the involvement of a third party.

Using DeFi enables you to perform the following actions:

Accessibility: Transactions on a DeFi platform take place anywhere there's an internet connection; hence, each person can also use it.

Low Fees and More Interest Rates: DeFi lets any parties speak approximately interest prices and lend money or cryptocurrencies over DeFi networks, all with low costs and high-interest quotes.

Security and Transparency: The general public can access records of completed transactions and smart contracts recorded on a blockchain for examination, but these records do not reveal your call. Because they are immutable, blockchains cannot be changed.

Autonomy: DeFi development is not dependent on centralized financial institutions. Financial carrier control isn't as essential or as expensive because of the decentralized structure of DeFi protocols.

Examples of DeFi Ecosystem

Any utility that offers financial offerings using blockchain and cryptocurrency technology is called DeFi. Certain packages can provide a wide variety of offerings, from fundamental ones like savings accounts to extra state-of-the-art ones like lending cash to buyers or groups. Aave, a “decentralized non-custodial liquidity market protocol” that permits absolutely everyone to engage as a liquidity provider or borrower, is one of the most well-known DeFi provider carriers.

With Aave, you could stake any cryptocurrency asset you very own to generate hobby revenue from potential loan recipients.

Use Cases of a DeFi Ecosystem

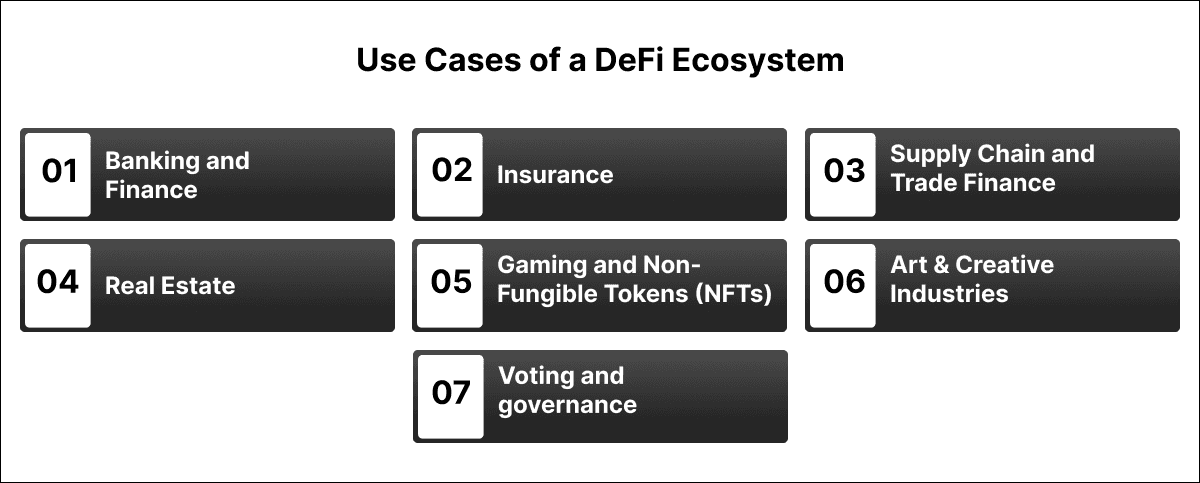

Decentralized Finance (DeFi) has established excellent programs in various industries and has rapidly increased its usage. Its openness and transparency, together with the automation supplied via smart contracts, have enabled innovative uses. Here are some well-known DeFi use cases across quite several industries:

Banking and Finance: DeFi is disrupting traditional banking with the aid of offering decentralized systems for lending and borrowing. The underbanked and unbanked populations nowadays have a less complicated right of entry to economic offerings due to the fact loans can be acquired without a credit score, take a look at or traditional collateral. DeFi provides an alternative to traditional financial savings accounts by enabling users to earn interest on their cryptocurrency holdings while participating in yield farming protocols.

Insurance: DeFi is transforming the coverage industry by offering decentralized coverage protocols. Peer-to-peer coverage solutions eliminate the need for traditional coverage companies by enabling individuals to pool their resources to cover specific risks. This tactic reduces prices, expedites the processing of claims, and fosters openness.

Supply Chain and Trade Finance: DeFi is accelerating supply chain finance via the development of decentralized solutions that allow organizations to access operating capital through the use of smart contracts. By offering automatic, trustless payment settlements, those systems lessen the chance of fraud and disputes in global exchange.

Real Estate: DeFi is revolutionizing the actual estate industry by enabling tokenized fractional ownership of residences. By obtaining tokens that represent a share of an asset, traders can also skip the standard front obstacles and increase their investment profile, even while gaining exposure to the real property market.

Gaming and Non-Fungible Tokens (NFTs): DeFi and the gaming enterprise have joined to enable gamers to buy, exchange, and promote in-game gadgets using non-fungible tokens. These specific virtual assets, which can serve as digital property, collectables, or rare merchandise, have the potential to generate additional revenue streams for gamers.

Art & Creative Industries: DeFi has transformed the art sector by tokenizing artists' creations as NFTs. Because of this, artists may now market their digital artwork to collectors rather than going through traditional galleries or public sale houses. Artists can also get royalties if their NFTs are resold at the secondary marketplace.

Voting and governance: DeFi is a pioneer in decentralized governance techniques, permitting token proprietors to participate in selections that affect the platform's growth and enhancement. This democratic technique allows customers to have a say in how the DeFi challenge they're worried about develops in the future.

These are just a few examples of how DeFi is introducing more green, handy, and obvious financial structures and revolutionizing several industries. As the era advances, extra industries are expected to embody DeFi answers, expanding the opportunities for global prosperity and innovation.

Benefits of a DeFi Ecosystem

The DeFi platform affords purchasers a number of blessings, which include better cost-effectiveness, greater transparency, and less difficult access to economic services.

1. Availability

One of the significant benefits of DeFi is its ability to provide financial services to individuals who might otherwise be excluded from the mainstream economy. This covers people who don’t fulfil the credit score requirements for conventional loans or who are living in locations without access to everyday banks.

2. Reduced prices

DeFi lowers the cost of financial offerings by eliminating middlemen like banks. Users may additionally benefit from reduced fees and progressed interest prices. DeFi additionally does away with the need for middlemen, which lowers transaction costs and improves transaction pace and efficiency.

3. Transparency

DeFi leverages the blockchain era to provide a transparent and steady ledger of all transactions. This level of transparency enables customers to comprehend the terms and conditions of various DeFi financial products, such as DeFi lending platforms, and track the performance of their investments in real-time.

4. Security

The foundation of DeFi's blockchain technology ensures a steady and tamper-proof environment for transactions. This high level of protection significantly lowers the risk of fraud and hacking, making DeFi structures, including DeFi lending structures, a safer alternative to traditional economic structures.

5. Innovation

DeFi fosters the improvement of revolutionary monetary products and services. For instance, DeFi's lending platforms and borrowing protocols offer users transparent funding options, while its decentralized investment structures enable access to a wider range of assets, thereby promoting innovation in the economic sector.

6. Decentralization

DeFi operates on a decentralized blockchain community, removing the need for a central authority. This decentralization empowers users with extra control over their monetary transactions and minimizes the hazard related to an unmarried factor of failure.

Different types of decentralized finance platforms

The DeFi surroundings have extended unexpectedly and now encompass numerous programs and structures. This section will explore the unique types of DeFi applications and systems, emphasizing their features and advantages over traditional, centralized finance.

1. Decentralized Exchanges (DEXs)

Decentralized exchanges are structures that facilitate cryptocurrency buying and selling without intermediaries. By leveraging smart contract technology, DEXs provide a stable, transparent, and quick trading procedure. Users benefit from extra control over their price range and the capability to alternate anonymously, distinguishing DEXs from centralized exchanges.

2. Lending and borrowing platforms

Lending and borrowing structures allow users to without delay lend and borrow budgets without the need for intermediaries. These systems make use of smart contracts to manipulate loans, ensuring security and transparency. Typically, loans are collateralized with belongings inclusive of cryptocurrencies or stablecoins, mitigating default dangers and showcasing a key difference between centralized vs. decentralized finance.

3. Stablecoins

Stablecoins are cryptocurrencies that are linked to tangible assets, similar to the US dollar. Designed to maintain a regular price, stablecoins are perfect for transactions and bills. They provide customers stability in the, in any case, unstable cryptocurrency marketplace, presenting a dependable alternative to standard finance alternatives.

4. Yield Farming

Yield farming involves lending cryptocurrencies to earn interest or rewards. Participants can deposit their property into liquidity pools, which can be used for trading on decentralized exchanges. The buying and selling sports generate rewards that are distributed to the depositors, illustrating a unique investment opportunity within decentralized finance in comparison to centralized finance structures.

5. Decentralized Identity Platforms

Decentralized identity systems provide users with the ability to manipulate their private records and digital identity. Using blockchain technology, those systems store data securely and in a decentralized manner, making sure customers have complete control over their facts. Additionally, decentralized identification systems allow customers to proportion their records securely and privately, imparting more desirable privacy in comparison to centralized identity control structures.

Conclusion

The DeFi ecosystem is reshaping the financial landscape by offering decentralized, transparent, and inclusive alternatives to traditional financial systems. Powered by blockchain technology and smart contracts, DeFi enables users to access a variety of financial services—from decentralized exchanges and lending platforms to innovative concepts like yield farming and decentralized governance. Its core principles of accessibility, autonomy, security, and reduced costs make it an appealing option for individuals and businesses alike, especially those who are underserved by conventional financial institutions. While challenges such as scalability and regulatory compliance remain, DeFi’s rapid growth demonstrates its potential to revolutionize the global economy by creating a more open and equitable financial future. As innovation continues in this space, DeFi's applications will likely expand further, unlocking new opportunities across various industries.

If you're ready to tap into the power of decentralized finance, Decentrablock is here to help. As experts in DeFi development, we offer comprehensive blockchain solutions that ensure secure, scalable, and efficient DeFi platforms. Contact us today to take the next step in transforming your financial operations with cutting-edge DeFi technology!

They offer customers stability in the otherwise volatile cryptocurrency market, providing a reliable alternative to traditional financial options. The emergence of the Decentralized Finance (DeFi) environment in recent years has brought about a major upheaval in the world of finance. DeFi has emerged as a progressive approach, providing conventional monetary institutions, beset by limitations and inefficiencies, with a decentralized, transparent, and inclusive opportunity. With blockchain technology and smart contracts, DeFi is growing to get admission to monetary tools, converting how monetary offerings are added, and empowering individuals to control their belongings like never before.

In this article, we will delve into the intricate workings of the DeFi ecosystem, highlighting its core principles, benefits, and diverse range of applications that have contributed to its rapid growth. In this blog, we will discuss DeFi's key principles, the issues they address, and how DeFi could potentially transform international financial practices. You can even find out how DeFi is revolutionizing the finance area and setting the stage for a more obvious and decentralized destiny.

What is a DeFi Ecosystem?

The DeFi Ecosystem, short for Decentralized Finance, is a network of economic programs built on blockchain technology. Unlike conventional monetary structures, which rely on intermediaries like banks and brokerages, DeFi operates on decentralized networks wherein transactions are ruled by smart contracts and peer-to-peer protocols.

Here’s a breakdown of the key additives and features of the DeFi Ecosystem:

Blockchain Technology: The foundation of DeFi is blockchain, which ensures the transparency, security, and immutability of transactions. Ethereum is the most popular blockchain for DeFi projects due to its strong, smart contract capabilities.

Smart Contracts: The situations of the contracts were explicitly encoded into code in those self-executing contracts. Smart contracts cast off the need for middlemen with the aid of automating and imposing a settlement’s requirements.

Decentralized Exchanges (DEXs): Platforms like Uniswap and Sushiswap permit customers to alternate cryptocurrencies directly with each other without a central authority. This reduces the risk of hacks and fraud related to centralized exchanges.

Decentralized Finance Applications: A diverse range of monetary offerings built on blockchain, consisting of lending protocols (like Compound and Aave), decentralized derivatives (like Synthetix), decentralized stablecoins (like MakerDAO), and yield farming protocols.

Liquidity Pools: Pools of tokens locked in smart contracts offer liquidity for decentralized change trading, permitting customers to exchange property seamlessly at the same time as earning fees or rewards.

Governance Tokens: Tokens supply holders with vote-casting rights and impact the decision-making method of decentralized protocols, empowering the community to control and evolve the surroundings.

Yield Farming: A method where customers provide liquidity to DeFi protocols in exchange for rewards, typically in the shape of extra tokens, governance rights, or a proportion of transaction expenses.

Flash Loans: Unsecured loans that are instantly borrowed and repaid within the identical transaction, enabled by way of smart contracts, often used for arbitrage and different buying and selling strategies without the need for collateral.

Automated Market Makers (AMMs): Decentralized protocols that use algorithms and liquidity swimming pools to facilitate token swaps, making sure non-stop liquidity and decreasing rate slippage for investors.

Interoperability: The potential of various DeFi protocols and systems to seamlessly engage and talk with each other, enhancing the general performance, usability, and composability of the atmosphere.

Understand the basics of the DeFi ecosystem

The fundamentals of the DeFi atmosphere are blockchain technology, smart contracts, and the ambition to update traditional monetary institutions. Building a decentralized, transparent, and open financial system without middlemen is the number one aim of DeFi.

The blockchain technology is the foundation of the DeFi environment. Transparency and immutability are ensured through a device called allotted ledgers, which makes use of a decentralized community of nodes to store records and transactions. Decentralization reduces the possibility of fraud and manipulation and does away with the necessity for centralized management.

Smart contracts, the fundamental components of DeFi programs, enable self-reliant and self-executing agreements. The execution of many monetary methods, which include borrowing, lending, buying and selling, and yield farming, is made simpler by using these programmable contracts. Smart contracts simplify transactions when specific conditions are met, thereby improving environmental protection and consideration.

Decentralized applications (dApps), which provide the consumer interface, enable customers to interact with DeFi protocols. These blockchain-based applications give users access to a variety of financial products and services. With the help of dApps, customers may manipulate their property, participate in decentralized exchanges, and apply for loans without the assistance of traditional monetary middlemen.

Interoperability is another crucial component of the DeFi environment. As the DeFi industry grows, initiatives are focusing on establishing go-chain interoperability to enhance accessibility and liquidity across various blockchain networks.

Despite its amazing promise, the DeFi atmosphere has challenges associated with scalability, protection, and regulatory compliance. However, its essential principles of accessibility, openness, and decentralization have sparked an economic revolution that has upended traditional banking and laid the foundation for a destiny in finance that is extra equitable and inclusive.

Objectives of a DeFi Ecosystem

One of the important principles of DeFi is peer-to-peer (P2P) financial transactions, in which two humans consent to trade cryptocurrency for services or products without the involvement of a third party.

Using DeFi enables you to perform the following actions:

Accessibility: Transactions on a DeFi platform take place anywhere there's an internet connection; hence, each person can also use it.

Low Fees and More Interest Rates: DeFi lets any parties speak approximately interest prices and lend money or cryptocurrencies over DeFi networks, all with low costs and high-interest quotes.

Security and Transparency: The general public can access records of completed transactions and smart contracts recorded on a blockchain for examination, but these records do not reveal your call. Because they are immutable, blockchains cannot be changed.

Autonomy: DeFi development is not dependent on centralized financial institutions. Financial carrier control isn't as essential or as expensive because of the decentralized structure of DeFi protocols.

Examples of DeFi Ecosystem

Any utility that offers financial offerings using blockchain and cryptocurrency technology is called DeFi. Certain packages can provide a wide variety of offerings, from fundamental ones like savings accounts to extra state-of-the-art ones like lending cash to buyers or groups. Aave, a “decentralized non-custodial liquidity market protocol” that permits absolutely everyone to engage as a liquidity provider or borrower, is one of the most well-known DeFi provider carriers.

With Aave, you could stake any cryptocurrency asset you very own to generate hobby revenue from potential loan recipients.

Use Cases of a DeFi Ecosystem

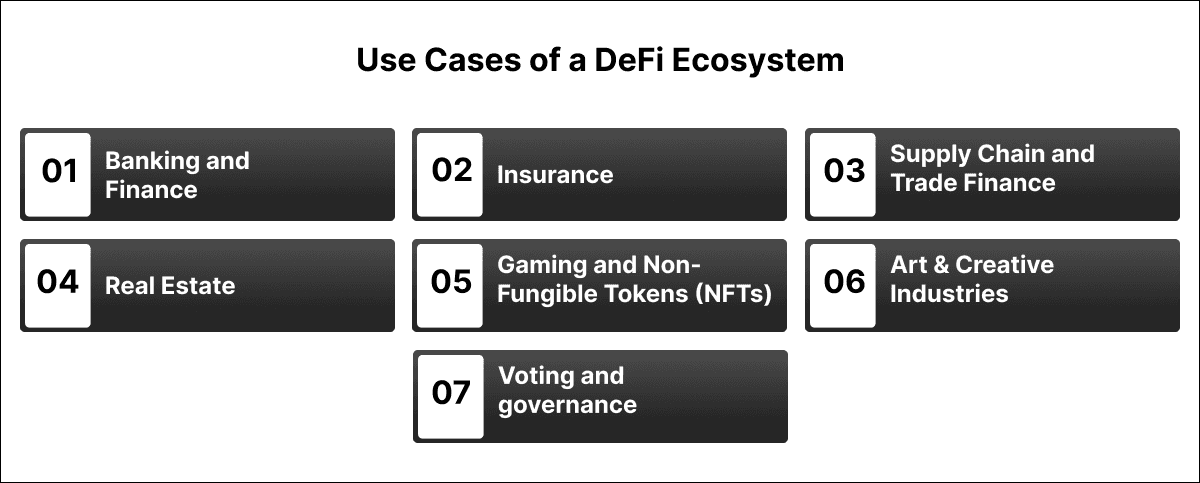

Decentralized Finance (DeFi) has established excellent programs in various industries and has rapidly increased its usage. Its openness and transparency, together with the automation supplied via smart contracts, have enabled innovative uses. Here are some well-known DeFi use cases across quite several industries:

Banking and Finance: DeFi is disrupting traditional banking with the aid of offering decentralized systems for lending and borrowing. The underbanked and unbanked populations nowadays have a less complicated right of entry to economic offerings due to the fact loans can be acquired without a credit score, take a look at or traditional collateral. DeFi provides an alternative to traditional financial savings accounts by enabling users to earn interest on their cryptocurrency holdings while participating in yield farming protocols.

Insurance: DeFi is transforming the coverage industry by offering decentralized coverage protocols. Peer-to-peer coverage solutions eliminate the need for traditional coverage companies by enabling individuals to pool their resources to cover specific risks. This tactic reduces prices, expedites the processing of claims, and fosters openness.

Supply Chain and Trade Finance: DeFi is accelerating supply chain finance via the development of decentralized solutions that allow organizations to access operating capital through the use of smart contracts. By offering automatic, trustless payment settlements, those systems lessen the chance of fraud and disputes in global exchange.

Real Estate: DeFi is revolutionizing the actual estate industry by enabling tokenized fractional ownership of residences. By obtaining tokens that represent a share of an asset, traders can also skip the standard front obstacles and increase their investment profile, even while gaining exposure to the real property market.

Gaming and Non-Fungible Tokens (NFTs): DeFi and the gaming enterprise have joined to enable gamers to buy, exchange, and promote in-game gadgets using non-fungible tokens. These specific virtual assets, which can serve as digital property, collectables, or rare merchandise, have the potential to generate additional revenue streams for gamers.

Art & Creative Industries: DeFi has transformed the art sector by tokenizing artists' creations as NFTs. Because of this, artists may now market their digital artwork to collectors rather than going through traditional galleries or public sale houses. Artists can also get royalties if their NFTs are resold at the secondary marketplace.

Voting and governance: DeFi is a pioneer in decentralized governance techniques, permitting token proprietors to participate in selections that affect the platform's growth and enhancement. This democratic technique allows customers to have a say in how the DeFi challenge they're worried about develops in the future.

These are just a few examples of how DeFi is introducing more green, handy, and obvious financial structures and revolutionizing several industries. As the era advances, extra industries are expected to embody DeFi answers, expanding the opportunities for global prosperity and innovation.

Benefits of a DeFi Ecosystem

The DeFi platform affords purchasers a number of blessings, which include better cost-effectiveness, greater transparency, and less difficult access to economic services.

1. Availability

One of the significant benefits of DeFi is its ability to provide financial services to individuals who might otherwise be excluded from the mainstream economy. This covers people who don’t fulfil the credit score requirements for conventional loans or who are living in locations without access to everyday banks.

2. Reduced prices

DeFi lowers the cost of financial offerings by eliminating middlemen like banks. Users may additionally benefit from reduced fees and progressed interest prices. DeFi additionally does away with the need for middlemen, which lowers transaction costs and improves transaction pace and efficiency.

3. Transparency

DeFi leverages the blockchain era to provide a transparent and steady ledger of all transactions. This level of transparency enables customers to comprehend the terms and conditions of various DeFi financial products, such as DeFi lending platforms, and track the performance of their investments in real-time.

4. Security

The foundation of DeFi's blockchain technology ensures a steady and tamper-proof environment for transactions. This high level of protection significantly lowers the risk of fraud and hacking, making DeFi structures, including DeFi lending structures, a safer alternative to traditional economic structures.

5. Innovation

DeFi fosters the improvement of revolutionary monetary products and services. For instance, DeFi's lending platforms and borrowing protocols offer users transparent funding options, while its decentralized investment structures enable access to a wider range of assets, thereby promoting innovation in the economic sector.

6. Decentralization

DeFi operates on a decentralized blockchain community, removing the need for a central authority. This decentralization empowers users with extra control over their monetary transactions and minimizes the hazard related to an unmarried factor of failure.

Different types of decentralized finance platforms

The DeFi surroundings have extended unexpectedly and now encompass numerous programs and structures. This section will explore the unique types of DeFi applications and systems, emphasizing their features and advantages over traditional, centralized finance.

1. Decentralized Exchanges (DEXs)

Decentralized exchanges are structures that facilitate cryptocurrency buying and selling without intermediaries. By leveraging smart contract technology, DEXs provide a stable, transparent, and quick trading procedure. Users benefit from extra control over their price range and the capability to alternate anonymously, distinguishing DEXs from centralized exchanges.

2. Lending and borrowing platforms

Lending and borrowing structures allow users to without delay lend and borrow budgets without the need for intermediaries. These systems make use of smart contracts to manipulate loans, ensuring security and transparency. Typically, loans are collateralized with belongings inclusive of cryptocurrencies or stablecoins, mitigating default dangers and showcasing a key difference between centralized vs. decentralized finance.

3. Stablecoins

Stablecoins are cryptocurrencies that are linked to tangible assets, similar to the US dollar. Designed to maintain a regular price, stablecoins are perfect for transactions and bills. They provide customers stability in the, in any case, unstable cryptocurrency marketplace, presenting a dependable alternative to standard finance alternatives.

4. Yield Farming

Yield farming involves lending cryptocurrencies to earn interest or rewards. Participants can deposit their property into liquidity pools, which can be used for trading on decentralized exchanges. The buying and selling sports generate rewards that are distributed to the depositors, illustrating a unique investment opportunity within decentralized finance in comparison to centralized finance structures.

5. Decentralized Identity Platforms

Decentralized identity systems provide users with the ability to manipulate their private records and digital identity. Using blockchain technology, those systems store data securely and in a decentralized manner, making sure customers have complete control over their facts. Additionally, decentralized identification systems allow customers to proportion their records securely and privately, imparting more desirable privacy in comparison to centralized identity control structures.

Conclusion

The DeFi ecosystem is reshaping the financial landscape by offering decentralized, transparent, and inclusive alternatives to traditional financial systems. Powered by blockchain technology and smart contracts, DeFi enables users to access a variety of financial services—from decentralized exchanges and lending platforms to innovative concepts like yield farming and decentralized governance. Its core principles of accessibility, autonomy, security, and reduced costs make it an appealing option for individuals and businesses alike, especially those who are underserved by conventional financial institutions. While challenges such as scalability and regulatory compliance remain, DeFi’s rapid growth demonstrates its potential to revolutionize the global economy by creating a more open and equitable financial future. As innovation continues in this space, DeFi's applications will likely expand further, unlocking new opportunities across various industries.

If you're ready to tap into the power of decentralized finance, Decentrablock is here to help. As experts in DeFi development, we offer comprehensive blockchain solutions that ensure secure, scalable, and efficient DeFi platforms. Contact us today to take the next step in transforming your financial operations with cutting-edge DeFi technology!

They offer customers stability in the otherwise volatile cryptocurrency market, providing a reliable alternative to traditional financial options. The emergence of the Decentralized Finance (DeFi) environment in recent years has brought about a major upheaval in the world of finance. DeFi has emerged as a progressive approach, providing conventional monetary institutions, beset by limitations and inefficiencies, with a decentralized, transparent, and inclusive opportunity. With blockchain technology and smart contracts, DeFi is growing to get admission to monetary tools, converting how monetary offerings are added, and empowering individuals to control their belongings like never before.

In this article, we will delve into the intricate workings of the DeFi ecosystem, highlighting its core principles, benefits, and diverse range of applications that have contributed to its rapid growth. In this blog, we will discuss DeFi's key principles, the issues they address, and how DeFi could potentially transform international financial practices. You can even find out how DeFi is revolutionizing the finance area and setting the stage for a more obvious and decentralized destiny.

What is a DeFi Ecosystem?

The DeFi Ecosystem, short for Decentralized Finance, is a network of economic programs built on blockchain technology. Unlike conventional monetary structures, which rely on intermediaries like banks and brokerages, DeFi operates on decentralized networks wherein transactions are ruled by smart contracts and peer-to-peer protocols.

Here’s a breakdown of the key additives and features of the DeFi Ecosystem:

Blockchain Technology: The foundation of DeFi is blockchain, which ensures the transparency, security, and immutability of transactions. Ethereum is the most popular blockchain for DeFi projects due to its strong, smart contract capabilities.

Smart Contracts: The situations of the contracts were explicitly encoded into code in those self-executing contracts. Smart contracts cast off the need for middlemen with the aid of automating and imposing a settlement’s requirements.

Decentralized Exchanges (DEXs): Platforms like Uniswap and Sushiswap permit customers to alternate cryptocurrencies directly with each other without a central authority. This reduces the risk of hacks and fraud related to centralized exchanges.

Decentralized Finance Applications: A diverse range of monetary offerings built on blockchain, consisting of lending protocols (like Compound and Aave), decentralized derivatives (like Synthetix), decentralized stablecoins (like MakerDAO), and yield farming protocols.

Liquidity Pools: Pools of tokens locked in smart contracts offer liquidity for decentralized change trading, permitting customers to exchange property seamlessly at the same time as earning fees or rewards.

Governance Tokens: Tokens supply holders with vote-casting rights and impact the decision-making method of decentralized protocols, empowering the community to control and evolve the surroundings.

Yield Farming: A method where customers provide liquidity to DeFi protocols in exchange for rewards, typically in the shape of extra tokens, governance rights, or a proportion of transaction expenses.

Flash Loans: Unsecured loans that are instantly borrowed and repaid within the identical transaction, enabled by way of smart contracts, often used for arbitrage and different buying and selling strategies without the need for collateral.

Automated Market Makers (AMMs): Decentralized protocols that use algorithms and liquidity swimming pools to facilitate token swaps, making sure non-stop liquidity and decreasing rate slippage for investors.

Interoperability: The potential of various DeFi protocols and systems to seamlessly engage and talk with each other, enhancing the general performance, usability, and composability of the atmosphere.

Understand the basics of the DeFi ecosystem

The fundamentals of the DeFi atmosphere are blockchain technology, smart contracts, and the ambition to update traditional monetary institutions. Building a decentralized, transparent, and open financial system without middlemen is the number one aim of DeFi.

The blockchain technology is the foundation of the DeFi environment. Transparency and immutability are ensured through a device called allotted ledgers, which makes use of a decentralized community of nodes to store records and transactions. Decentralization reduces the possibility of fraud and manipulation and does away with the necessity for centralized management.

Smart contracts, the fundamental components of DeFi programs, enable self-reliant and self-executing agreements. The execution of many monetary methods, which include borrowing, lending, buying and selling, and yield farming, is made simpler by using these programmable contracts. Smart contracts simplify transactions when specific conditions are met, thereby improving environmental protection and consideration.

Decentralized applications (dApps), which provide the consumer interface, enable customers to interact with DeFi protocols. These blockchain-based applications give users access to a variety of financial products and services. With the help of dApps, customers may manipulate their property, participate in decentralized exchanges, and apply for loans without the assistance of traditional monetary middlemen.

Interoperability is another crucial component of the DeFi environment. As the DeFi industry grows, initiatives are focusing on establishing go-chain interoperability to enhance accessibility and liquidity across various blockchain networks.

Despite its amazing promise, the DeFi atmosphere has challenges associated with scalability, protection, and regulatory compliance. However, its essential principles of accessibility, openness, and decentralization have sparked an economic revolution that has upended traditional banking and laid the foundation for a destiny in finance that is extra equitable and inclusive.

Objectives of a DeFi Ecosystem

One of the important principles of DeFi is peer-to-peer (P2P) financial transactions, in which two humans consent to trade cryptocurrency for services or products without the involvement of a third party.

Using DeFi enables you to perform the following actions:

Accessibility: Transactions on a DeFi platform take place anywhere there's an internet connection; hence, each person can also use it.

Low Fees and More Interest Rates: DeFi lets any parties speak approximately interest prices and lend money or cryptocurrencies over DeFi networks, all with low costs and high-interest quotes.

Security and Transparency: The general public can access records of completed transactions and smart contracts recorded on a blockchain for examination, but these records do not reveal your call. Because they are immutable, blockchains cannot be changed.

Autonomy: DeFi development is not dependent on centralized financial institutions. Financial carrier control isn't as essential or as expensive because of the decentralized structure of DeFi protocols.

Examples of DeFi Ecosystem

Any utility that offers financial offerings using blockchain and cryptocurrency technology is called DeFi. Certain packages can provide a wide variety of offerings, from fundamental ones like savings accounts to extra state-of-the-art ones like lending cash to buyers or groups. Aave, a “decentralized non-custodial liquidity market protocol” that permits absolutely everyone to engage as a liquidity provider or borrower, is one of the most well-known DeFi provider carriers.

With Aave, you could stake any cryptocurrency asset you very own to generate hobby revenue from potential loan recipients.

Use Cases of a DeFi Ecosystem

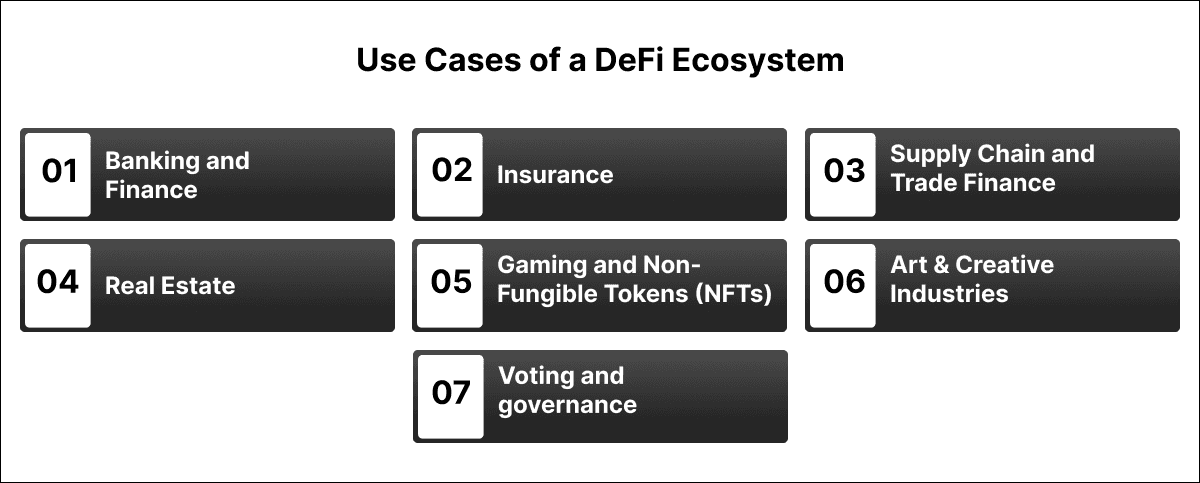

Decentralized Finance (DeFi) has established excellent programs in various industries and has rapidly increased its usage. Its openness and transparency, together with the automation supplied via smart contracts, have enabled innovative uses. Here are some well-known DeFi use cases across quite several industries:

Banking and Finance: DeFi is disrupting traditional banking with the aid of offering decentralized systems for lending and borrowing. The underbanked and unbanked populations nowadays have a less complicated right of entry to economic offerings due to the fact loans can be acquired without a credit score, take a look at or traditional collateral. DeFi provides an alternative to traditional financial savings accounts by enabling users to earn interest on their cryptocurrency holdings while participating in yield farming protocols.

Insurance: DeFi is transforming the coverage industry by offering decentralized coverage protocols. Peer-to-peer coverage solutions eliminate the need for traditional coverage companies by enabling individuals to pool their resources to cover specific risks. This tactic reduces prices, expedites the processing of claims, and fosters openness.

Supply Chain and Trade Finance: DeFi is accelerating supply chain finance via the development of decentralized solutions that allow organizations to access operating capital through the use of smart contracts. By offering automatic, trustless payment settlements, those systems lessen the chance of fraud and disputes in global exchange.

Real Estate: DeFi is revolutionizing the actual estate industry by enabling tokenized fractional ownership of residences. By obtaining tokens that represent a share of an asset, traders can also skip the standard front obstacles and increase their investment profile, even while gaining exposure to the real property market.

Gaming and Non-Fungible Tokens (NFTs): DeFi and the gaming enterprise have joined to enable gamers to buy, exchange, and promote in-game gadgets using non-fungible tokens. These specific virtual assets, which can serve as digital property, collectables, or rare merchandise, have the potential to generate additional revenue streams for gamers.

Art & Creative Industries: DeFi has transformed the art sector by tokenizing artists' creations as NFTs. Because of this, artists may now market their digital artwork to collectors rather than going through traditional galleries or public sale houses. Artists can also get royalties if their NFTs are resold at the secondary marketplace.

Voting and governance: DeFi is a pioneer in decentralized governance techniques, permitting token proprietors to participate in selections that affect the platform's growth and enhancement. This democratic technique allows customers to have a say in how the DeFi challenge they're worried about develops in the future.

These are just a few examples of how DeFi is introducing more green, handy, and obvious financial structures and revolutionizing several industries. As the era advances, extra industries are expected to embody DeFi answers, expanding the opportunities for global prosperity and innovation.

Benefits of a DeFi Ecosystem

The DeFi platform affords purchasers a number of blessings, which include better cost-effectiveness, greater transparency, and less difficult access to economic services.

1. Availability

One of the significant benefits of DeFi is its ability to provide financial services to individuals who might otherwise be excluded from the mainstream economy. This covers people who don’t fulfil the credit score requirements for conventional loans or who are living in locations without access to everyday banks.

2. Reduced prices

DeFi lowers the cost of financial offerings by eliminating middlemen like banks. Users may additionally benefit from reduced fees and progressed interest prices. DeFi additionally does away with the need for middlemen, which lowers transaction costs and improves transaction pace and efficiency.

3. Transparency

DeFi leverages the blockchain era to provide a transparent and steady ledger of all transactions. This level of transparency enables customers to comprehend the terms and conditions of various DeFi financial products, such as DeFi lending platforms, and track the performance of their investments in real-time.

4. Security

The foundation of DeFi's blockchain technology ensures a steady and tamper-proof environment for transactions. This high level of protection significantly lowers the risk of fraud and hacking, making DeFi structures, including DeFi lending structures, a safer alternative to traditional economic structures.

5. Innovation

DeFi fosters the improvement of revolutionary monetary products and services. For instance, DeFi's lending platforms and borrowing protocols offer users transparent funding options, while its decentralized investment structures enable access to a wider range of assets, thereby promoting innovation in the economic sector.

6. Decentralization

DeFi operates on a decentralized blockchain community, removing the need for a central authority. This decentralization empowers users with extra control over their monetary transactions and minimizes the hazard related to an unmarried factor of failure.

Different types of decentralized finance platforms

The DeFi surroundings have extended unexpectedly and now encompass numerous programs and structures. This section will explore the unique types of DeFi applications and systems, emphasizing their features and advantages over traditional, centralized finance.

1. Decentralized Exchanges (DEXs)

Decentralized exchanges are structures that facilitate cryptocurrency buying and selling without intermediaries. By leveraging smart contract technology, DEXs provide a stable, transparent, and quick trading procedure. Users benefit from extra control over their price range and the capability to alternate anonymously, distinguishing DEXs from centralized exchanges.

2. Lending and borrowing platforms

Lending and borrowing structures allow users to without delay lend and borrow budgets without the need for intermediaries. These systems make use of smart contracts to manipulate loans, ensuring security and transparency. Typically, loans are collateralized with belongings inclusive of cryptocurrencies or stablecoins, mitigating default dangers and showcasing a key difference between centralized vs. decentralized finance.

3. Stablecoins

Stablecoins are cryptocurrencies that are linked to tangible assets, similar to the US dollar. Designed to maintain a regular price, stablecoins are perfect for transactions and bills. They provide customers stability in the, in any case, unstable cryptocurrency marketplace, presenting a dependable alternative to standard finance alternatives.

4. Yield Farming

Yield farming involves lending cryptocurrencies to earn interest or rewards. Participants can deposit their property into liquidity pools, which can be used for trading on decentralized exchanges. The buying and selling sports generate rewards that are distributed to the depositors, illustrating a unique investment opportunity within decentralized finance in comparison to centralized finance structures.

5. Decentralized Identity Platforms

Decentralized identity systems provide users with the ability to manipulate their private records and digital identity. Using blockchain technology, those systems store data securely and in a decentralized manner, making sure customers have complete control over their facts. Additionally, decentralized identification systems allow customers to proportion their records securely and privately, imparting more desirable privacy in comparison to centralized identity control structures.

Conclusion

The DeFi ecosystem is reshaping the financial landscape by offering decentralized, transparent, and inclusive alternatives to traditional financial systems. Powered by blockchain technology and smart contracts, DeFi enables users to access a variety of financial services—from decentralized exchanges and lending platforms to innovative concepts like yield farming and decentralized governance. Its core principles of accessibility, autonomy, security, and reduced costs make it an appealing option for individuals and businesses alike, especially those who are underserved by conventional financial institutions. While challenges such as scalability and regulatory compliance remain, DeFi’s rapid growth demonstrates its potential to revolutionize the global economy by creating a more open and equitable financial future. As innovation continues in this space, DeFi's applications will likely expand further, unlocking new opportunities across various industries.

If you're ready to tap into the power of decentralized finance, Decentrablock is here to help. As experts in DeFi development, we offer comprehensive blockchain solutions that ensure secure, scalable, and efficient DeFi platforms. Contact us today to take the next step in transforming your financial operations with cutting-edge DeFi technology!

DecentraBlock is at the forefront of blockchain innovation, revolutionizing how businesses secure, transact, and grow in the digital age. Join us on a journey to harness the full potential of decentralized technology for a more efficient and transparent future.

Services

Subscribe to Our Newsletter

Get the latest news, updates, and insights on blockchain technology directly to your inbox. Sign up for our newsletter today!

© 2024 DecentraBlock. All rights reserved.

DecentraBlock is at the forefront of blockchain innovation, revolutionizing how businesses secure, transact, and grow in the digital age. Join us on a journey to harness the full potential of decentralized technology for a more efficient and transparent future.

Services

Subscribe to Our Newsletter

Get the latest news, updates, and insights on blockchain technology directly to your inbox. Sign up for our newsletter today!

© 2024 DecentraBlock. All rights reserved.

DecentraBlock is at the forefront of blockchain innovation, revolutionizing how businesses secure, transact, and grow in the digital age. Join us on a journey to harness the full potential of decentralized technology for a more efficient and transparent future.

Services

Subscribe to Our Newsletter

Get the latest news, updates, and insights on blockchain technology directly to your inbox. Sign up for our newsletter today!

© 2024 DecentraBlock. All rights reserved.